The Government of British Columbia is responsible for managing all of the revenue of the province. The Cabinet informs the Legislative Assembly of the financial requirements of the government. In turn, the Legislative Assembly authorizes the supply (grants of money) and the taxes. No tax may be imposed or money spent without the consent of the Legislative Assembly.

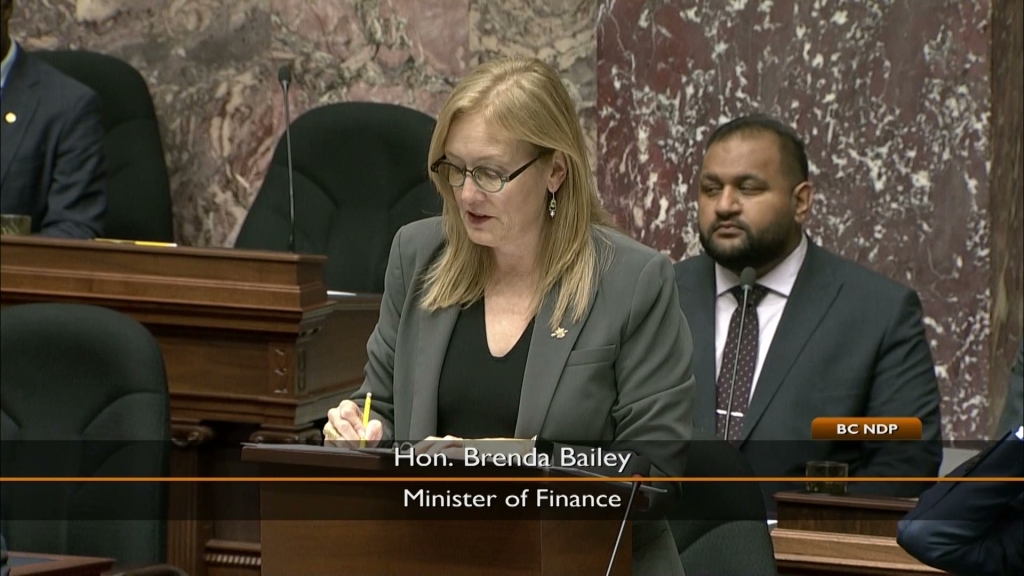

MLAs are responsible for debating and voting on "Estimates" as part of this budget process. Estimates are the money requested by the Lieutenant Governor - but presented to the Assembly by the Minister of Finance - on behalf of government ministries to fund programs and pay staff for the upcoming fiscal year. Every financial appropriation (allotment) approved by the Legislative Assembly is passed in the form of legislation known as a supply bill. Once the Legislative Assembly has debated and voted on all the financial requests for each ministry, it will approve a final supply bill. The passing of this bill authorizes the government to withdraw from the Consolidated Revenue Fund amounts up to but not exceeding those approved by the Legislative Assembly.

Approval of taxation by the Legislative Assembly is secured in the form of adopting a taxation bill introduced in the Assembly and subjected to the usual stages of consideration for public bills.